Social security taken out of paycheck

Thats because the IRS imposes a 124 Social Security tax and a 29 Medicare tax on net earnings. If you receive a paycheck stub each payday your.

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

If youre working in the United States youll see Social Security and Medicare tax withheld from your regular paychecks.

. For the 2021 tax year the wage base limit is 142800. You are a degree-seeking student in good standing attending school at least 12 time and you. Once an employees salary reaches that limit they are no longer required to pay this tax.

All employers are required to withhold Social Security tax from employees paychecks unless an exemption applies. Much the same as all of your other income you can set up your Social Security payments to have tax withheld. As of 2021 your wages up to 142800 147000 for 2022 are taxed at 62 for Social Security and your wages with no limit are taxed at 145 for Medicare.

Half of this amount or 6200 plus another 1450 in. In this case social security is taken out of ones paycheck not. Social security is simply designed to pay retired workers that are 65 years and older.

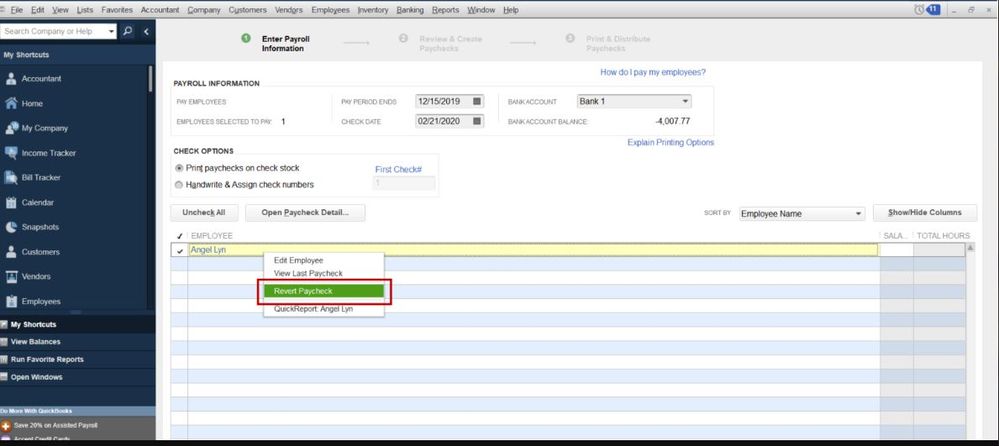

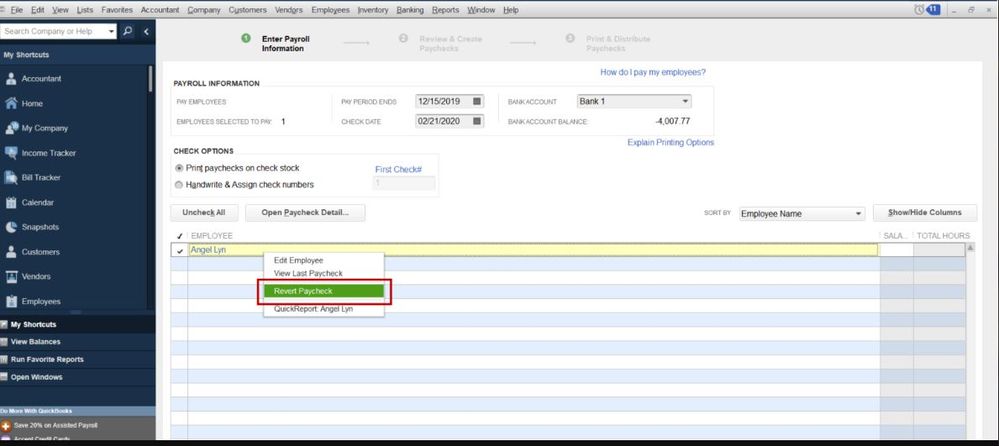

The change to the taxable maximum called the contribution and benefit base is based. Then if QuickBooks over withheld the Social Security and Medicare taxes there are two ways to resolve this. Any income you earn beyond the wage cap amount is not subject to a 62 Social Security payroll tax.

The money you put in these accounts is also taken from your paycheck before taxes and you can use those pre-tax dollars to pay for medical-related expenses like copays or. Employers and employees split. How is Social Security taxed on paycheck.

What is social security. Since this is under the wage cap the 124 Social Security tax rate is applied and 12400 in Social Security tax is due. Your income is taxed at a steady rate up to the Social.

There is no exemption for paying the Federal Insurance Contribution Act FICA payroll taxes that fund. Both employees and their employers pay into Social Security with 62 percent of an. Apply the taxes to your next paycheck.

For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security. The amount liable to Social Security tax is capped at 142800 in 2021 but will rise to 147000 in 2022. Typically employees and their employers split that bill which is why employees have.

You would be totally on your own if it. Paycheck Deductions for 1000 Paycheck. However as the baby.

There are several reasons social security tax was not withheld from your paycheck. There is no exemption for paying the Federal Insurance Contribution Act FICA payroll taxes that fund the Social. For example an employee who earns 165000 in 2022 will pay 9114 in.

Do you have to have Social Security taken out of your paycheck. The Social Security Administration is currently collecting more income than it pays out in the benefits and the combined trust fund has reached 29 trillion. Withholding From Your Social Security Benefit.

Claiming Social Security at 62 while working How Much Fica Tax Does Your Employer Pay On The Taxable Portion Of Your Income. In America you are mostly on your own for retirement. Should Social Security be taken out of my paycheck.

How Much Do I Deduct From My Paycheck To Be Ok In Retirement Tweet This.

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

Different Types Of Payroll Deductions Gusto

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

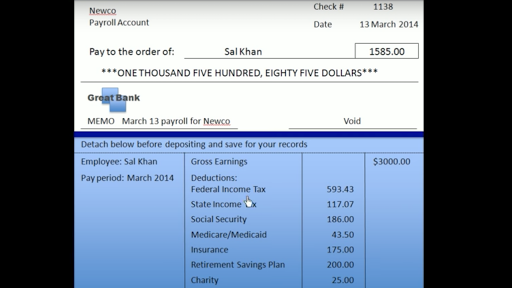

Anatomy Of A Paycheck Video Paycheck Khan Academy

Is There A Way To Print A Social Security Number On The Pay Stub

What Is Fed Med Ee Tax

What Is Fica Tax Contribution Rates Examples

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Understanding Your Paycheck

Paycheck Taxes Federal State Local Withholding H R Block

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

How To Get The Maximum Social Security Benefit Smartasset

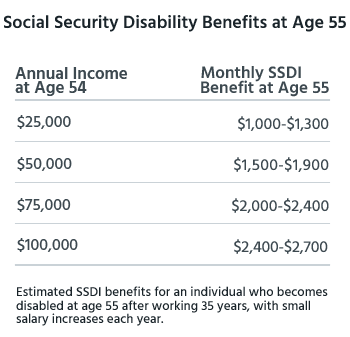

How Much Can You Get In Social Security Disability Benefits Disabilitysecrets

Understanding Your Paycheck Credit Com

Solved No Medicare Or Social Security Tax Taken Out Of One Employee S Check

What To Do When Excess Social Security Tax Is Withheld Stanfield O Dell Tulsa Cpa Firm